THE Government will provide a 50 percent duty exemption on fuel imports and will remove sales tax on fuel across the board for 6 months effective from 1st June 2022.

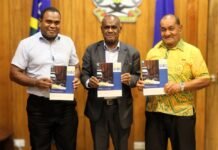

This incentive was announced in Parliament by the Minister of Finance and Treasury, Harry Kuma when tabling the 2022 appropriation bill in its second reading.

This is to ensure that the current increase in fuel prices does not have a serious impact on all businesses, especially those in rural areas.

Minister Kuma also announced other tax relief incentives which included:

The extension of deadlines to lodge tax returns.

Deferral of tax payments was appropriate based on a case-by-case basis.

Temporary suspension of penalties and interests for late filing to reduce cash flow pressures on businesses.

Fast track the process of tax refunds to support cash flows or allow refunds to be offset against tax debts.

Provide specific tax holidays for the tourism sector and Consider goods tax exemptions on personal protective equipment (PPE).

Mr. Kuma said the Inland Revenue Division (IRD) is faced with the greater challenge of balancing revenue collection with mitigating the impact of the civil unrest and the covid-19 pandemic on businesses and households.

The Government is aware that there is also a need to allow for a degree of flexibility to allow businesses to recover and grow and provide breathing space to ease pressure on cash flow shortages, and help businesses to retain employment levels.

However, Minister Kuma said that it must be recognized that with revenues projected to decline against baseline projections, any tax administration measures introduced to assist taxpayers must not pose a further challenge for IRD to meet its revenue targets, and pose a significant risk to public service delivery, should revenue shortfalls be larger than anticipated.

Despite these concerns, the Government is prepared to offer the following tax reliefs to help businesses in their recovery efforts.

SOURCE: GCU PRESS